Digitalise and Automate loan origination and streamline the on-boarding process by allowing your potential borrowers to make an online application through logical forms. Seamless user experience to make it easy and simple to provide their information to make credit decisions.

Thoroughly evaluate the financial standing of potential borrowers. Automate application processing, lower operating costs, and enable quicker turnaround on decisions.

With electronic signature ability Complete agreements faster with significant savings by eliminating paper and manual processes. Store and access customer information in a hassle-free way. Easily manage loan contracts, disclosure statements & other documents.

Collect business statistics and take advantage of helpful data visualization tools. Make insights come alive and communicate complicated ideas in simple visual messages.

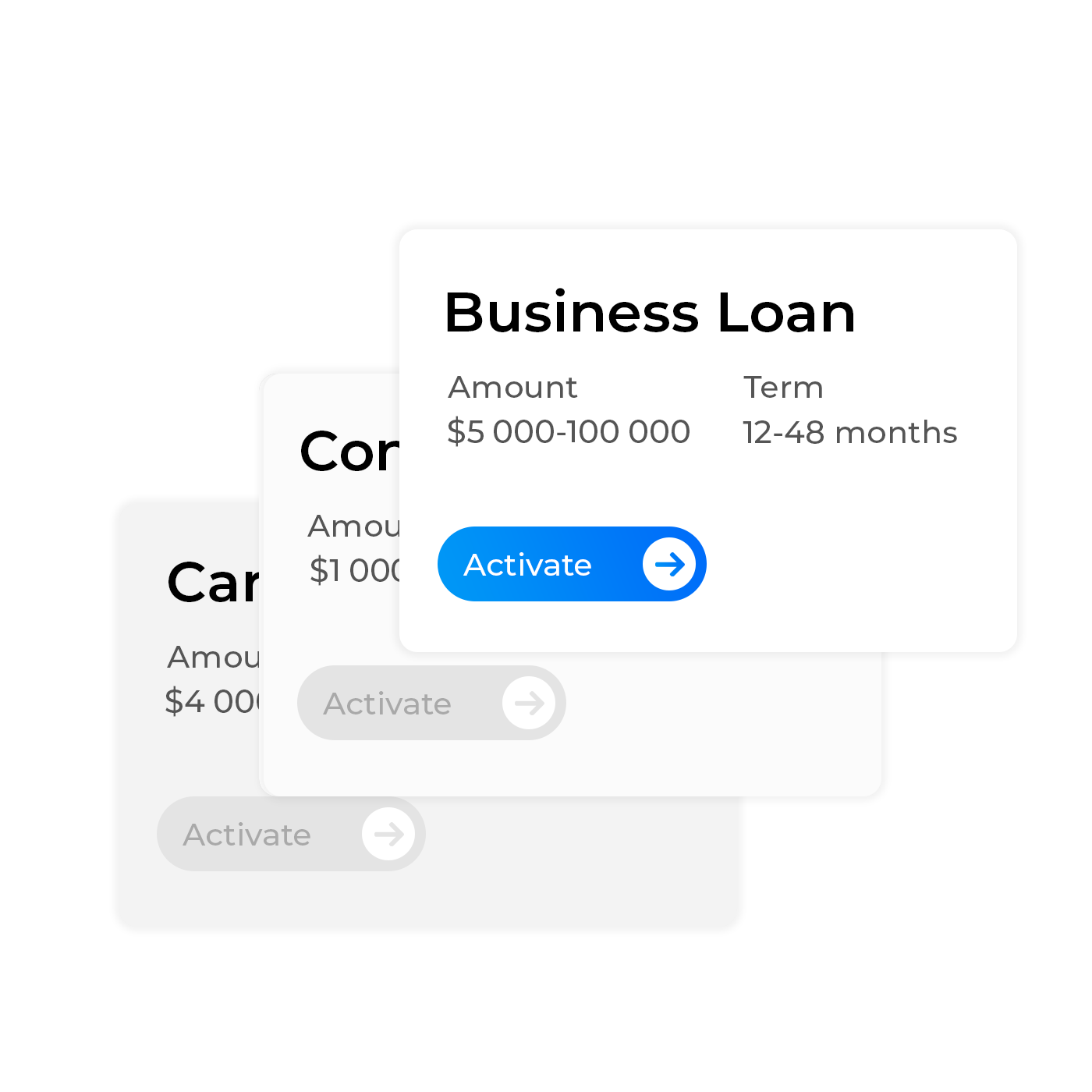

Create diverse and flexible financial products by configuring dozens of parameters. Reach new markets with lending products of any type:

Verify customer identities and mitigate fraud risk by utilizing data from credit bureaus

Utilize AI-powered scoring software to approve more creditworthy borrowers and reduce NPLs. The LPAAS Platform is be integrated with third-party solution providers for credit scoring systems.

Notifications are an integral part of every lender’s communication tools with customers and prospects. Integrate with email providers to send notifying transactions or prompts to complete loan application.

Intelligent consumer financing platform that automates every step of the lending process.

Intelligent Debt Consolidation platform that automates every step of the lending process.

Automate every step of micro lending process from onboarding to repayment. Trusted by 65 microfinance lenders.

Automate short-term consumer lending processes. Trusted by dozens of MFIs and PDL lenders.

A fully customizable auto finance platform for dealerships, with security registration module